Unlocking Hidden Value:

In today’s fast-paced world, many individuals find themselves facing unexpected financial challenges. Whether it’s an unforeseen medical expense, a sudden car repair, or simply the need for some extra cash to cover bills, people often search for innovative ways to secure quick funds. One such solution that has gained popularity in recent years is asset pawning. At Sapphire Pawnbrokers, we understand the value of your assets and how they can provide a lifeline in times of need. In this blog, we’ll delve into the reasons why someone would consider pawning their assets and how it can be a smart financial move.

Why Pawn Your Assets?

1. Quick Access to Cash

Sometimes, emergencies don’t wait for your next paycheck. Pawnbrokers offer a fast and convenient way to access cash. By using your assets as collateral, you can secure a loan within minutes, bypassing the lengthy approval processes associated with traditional lenders.

2. No Credit Checks

Unlike banks and credit unions, pawnbrokers do not conduct credit checks. Your credit history won’t affect your ability to pawn your assets. This makes pawning an attractive option for individuals with less-than-perfect credit scores.

3. Preserve Ownership

One of the most significant advantages of pawning is that you retain ownership of your assets. You can redeem them once you’ve repaid the loan, ensuring that cherished heirlooms, jewelry, or electronics are never permanently lost.

4. Flexible Loan Terms

At Sapphire Pawnbrokers, we offer flexible loan terms, allowing you to choose a repayment plan that suits your needs and budget. This flexibility ensures that you can comfortably reclaim your items without additional financial strain.

How Does It Work?

Pawning your assets is a straightforward process:

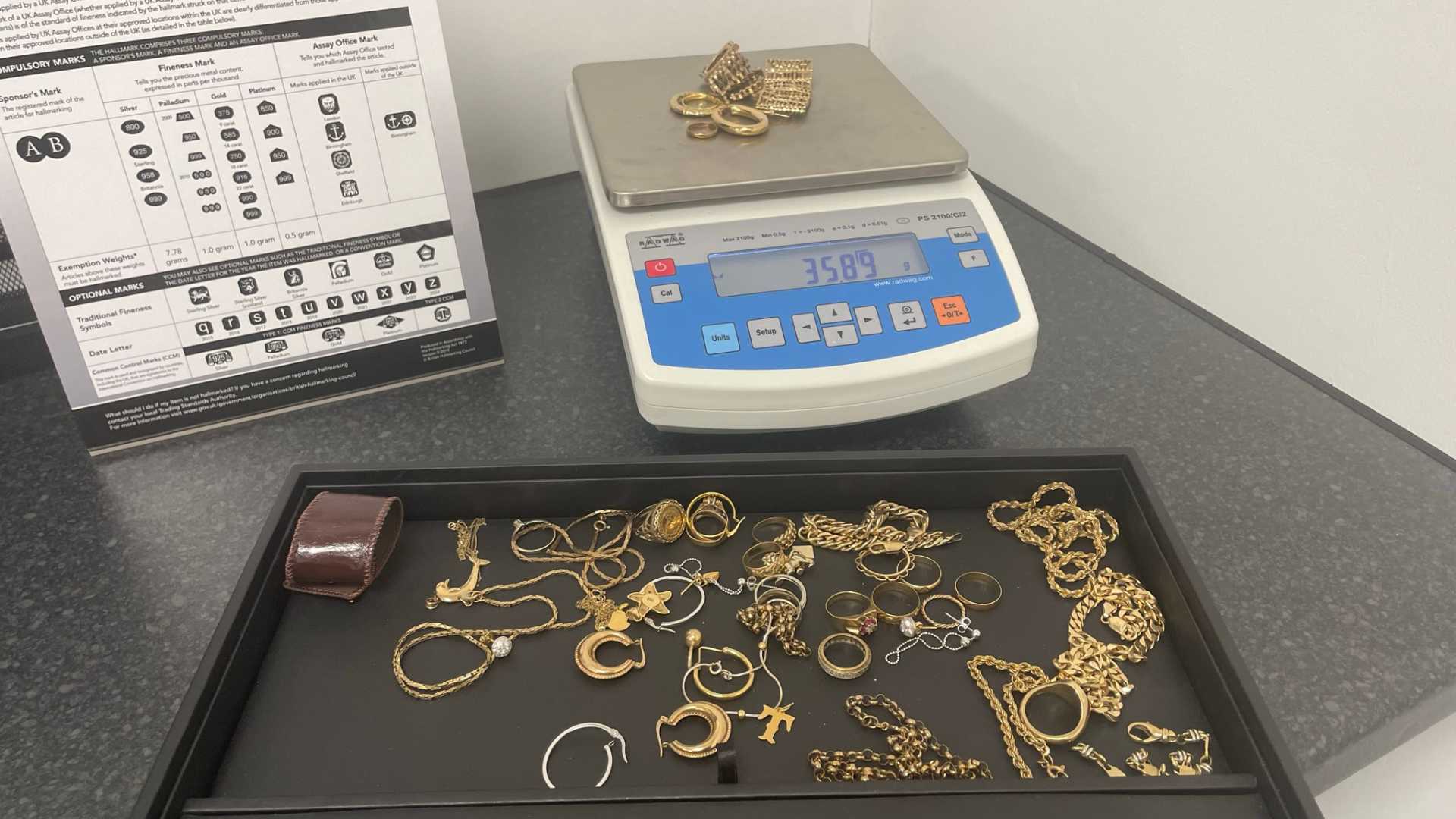

- Visit Sapphire Pawnbrokers: Bring your valuable items to our secure location at . Our friendly staff will assess your items and determine their value.

- Receive an Offer: Based on the assessed value, we’ll make a loan offer. You can choose to accept or negotiate the terms.

- Secure Your Loan: Once you accept the offer, you’ll receive cash in hand. Your items will be securely stored until you repay the loan.

- Reclaim Your Items: Pay back the loan, along with any interest and fees, within the agreed-upon timeframe to reclaim your assets.

Conclusion

When financial challenges arise, pawning your assets at Sapphire Pawnbrokers can be a smart solution. It offers quick access to cash, doesn’t involve credit checks, and allows you to maintain ownership of your valuable items. Plus, our flexible loan terms ensure that the process is tailored to your unique needs. For more information or to get started today, visit our store

28 Mason Street, Manchester M4 5EY or call us at 0161 273 3227.

Unlock the hidden value in your assets with Sapphire Pawnbrokers and secure your financial future.

Don’t let financial hurdles hold you back. Contact Sapphire Pawnbrokers today to explore how pawning your assets can provide the financial assistance you need, with no strings attached. Your valuable assets are your key to unlocking cash when you need it most.