Pawnbroking in the UK: A Step-by-Step Guide

Pawnbroking is a long-standing practice in the UK that allows people to use personal property as collateral to secure a loan. It serves as an alternative source of financing for those who may not have access to traditional lending sources. If you’re considering pawnbroking, either as a customer or an operator, here is an overview of how it works:

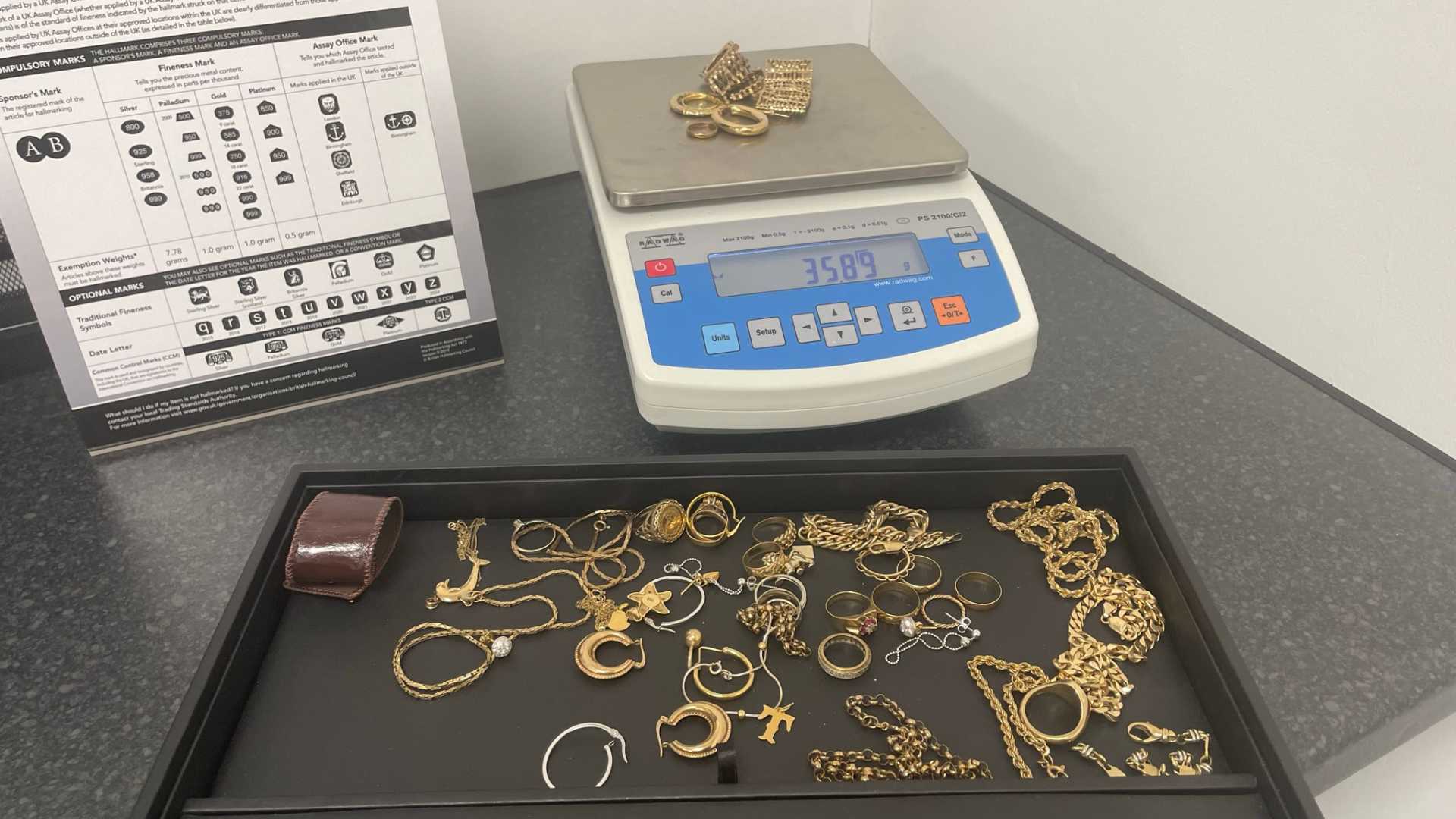

Step 1 – Valuation

The first step is to bring the item you wish to pawn to a pawnbroker for valuation. The pawnbroker will inspect the item and determine how much they can lend based on its resale value. Common pawned items include jewelry, electronics, musical instruments, power tools, and more. The pawnbroker will offer a loan amount that is a percentage of the item’s resale value.

Step 2 – Secured Loan

Once an amount is agreed upon, the pawnbroker provides a cash loan secured by the customer’s item. The customer hands over their item as collateral, and in exchange receives the cash loan. The loan amount and terms, including interest rate and repayment deadline, are detailed in a recipt . The pawn ticket allows the customer to retrieve their pawned item when repaying the loan.

Step 3 – Storage & Sale

The pawnbroker securely stores the pawned item during the loan period. If the customer does not repay the loan by the deadline, which can range from a month to a year, the pawnbroker gains ownership of the item. They may then offer it for sale to recoup the loan amount. However, customers can usually renew a pawn loan before it comes due by paying any interest owed.

Step 4 – Redemption or Renewal

When the customer returns to repay the loan, known as redeeming the pawn, they must repay the principal plus any interest or fees. Upon repayment, the pawnbroker returns the pawned item. If more time is needed, many pawnbrokers allow loan renewals by just paying the interest owing.

Step 5 – Regulations

Pawnbrokers must follow regulations regarding transparency in pricing and procedures. They must clearly display their fees and interest . Strict record-keeping and security measures for customers’ items are also enforced. Customers have protections such as grievance procedures if disputes arise.

Contact Us

If you are considering using a pawnbroker, be sure to contact Sapphire Pawnbrokers to discuss your needs. Our experienced team can walk you through the pawnbroking process and provide customised loan options. Don’t hesitate to get in touch today to see how pawnbroking can help meet your financing needs!