Pawnbroking and collateral loans date back more than 3,000 years, with the first pawn shops opening in China to provide short-term credit for low-paid workers and peasants.

Ancient Greeks and Romans

Ancient Greeks and Romans were also familiar with pawn shops; indeed, the pawn is derived from the Latin word “patinum”, which means pledged. Through the centuries, anyone with fast cash and valuables to act as security has been able to access pawnbroker services to exchange valuable items for cash loan advances with interest charges. Likewise, pawnbrokers retained the goods if their clients failed to repay their loans, plus interest.

In some form or another, collateral lending, or pawnbroking, has been around for centuries. Since the 5th Century in China, people have used items as collateral for loans.

The Chinese Origin

During the 5th Century, Chinese Buddhist monasteries became the first pawnbrokers owned and operated by monks. Wealthy private individuals sometimes set up these joint ventures with monasteries, since monasteries were sometimes tax-exempt. It is quite possible that pawnbroking existed in some form or another long before these examples of pawn shops were recorded.

European Pawnbroking

When the Roman Empire was at its height, pawnbroking reached Europe. There can be no doubt that the Roman Empire had a significant impact on modern-day pawnbroking; many laws that govern the pawnbroking industry today are derived from Roman law. However, Roman laws have not been copied verbatim. The Roman Empire had strict rules on what you could and could not take to a pawnbroker as collateral against a loan. Collateral could not be used for clothing, furniture, or farming equipment.

Religion And Pawnbroking

Jews and Christians were forbidden to lend money and profit from interest repayments in the earliest days of pawnbroking. According to the Book of Ezekiel in the Old Testament, charging interest on loans is one of the worst sins. In contrast, both the Torah and Talmud encourage lending money and goods to other Jews without charging interest. It was not forbidden for Jews to make interest-bearing loans to non-Jews. Prior to the Protestant Reformation, Christians were forbidden from providing interest-bearing loans and cash advances. The Franciscan church was permitted to practice usury in order to provide aid to the poor.

Medieval Pawnbroking

“Montes de Piete” was initially a form of basic pawnbroking set up by the Roman Popes to lend money to the poor. These loans were interest-free and would be covered by pledges like clothing or equipment. As the original establishments were expensive to operate and did not make any profit, interest on loans was more commonly charged to cover expenses and operational costs. Pawn shops charging interest for loans spread throughout Europe from their humble origins in Italy. In 1622, pawn shops were established in Ghent, Amsterdam, and Brussels, and most major European cities followed.

Medieval Italy

The practice of collateral lending was greatly accelerated in Medieval Italy, where merchants of the Lombardy region – many of them linked to the wealthy Medici family – spread it across Europe. Lombard merchants are also credited with creating the pawnbroking symbol of three golden balls – originally three golden coins – that hung outside their shops. Pawnbrokers’ signs have evolved into a globally recognized symbol.

Pope Leo X

In the 16th Century, Pope Leo X declared pawnbroking a legal profession throughout Catholic Europe and excommunicated anyone who questioned its legality. This ruling firmly entrenched pawnbroking in European financial life for years to come.

Lombards

In the wealthy region of Lombardy in Italy, Lombard banking originated with the original “montes de piete” pawn shop brokers. It’s still possible to find Lombard Streets and Lombard Alleys in major cities around the globe, indicating that they were once the location for prominent pawn shops.

Pawnbrokers became known as Lombards throughout Europe and the UK. In today’s banking environment, most major banks will lend against marketable securities via their secured loan procedures. Three golden balls were originally symbols of Lombard pawn banks and the Medici family of Florence.

Britain During The Medieval Period

It wasn’t until the Lombard merchants arrived later on that collateral lending gained popularity in Britain. During Medieval times, Lombard merchants had some high-profile clients, including Edward III and Henry V, who pawned royal artefacts to fund their wars with France. Through this time, their popularity grew until they became an established part of London’s financial sector. Lombard Street was named after the merchants because of their impact on the City of London.

Since 1785, pawnbrokers in the UK have been required to be licensed. After 75 years, the Pawnbroker’s Licence Law of 1872, which brought in many of the laws still governing pawnbroking today, overturned the legislation.

Current Day

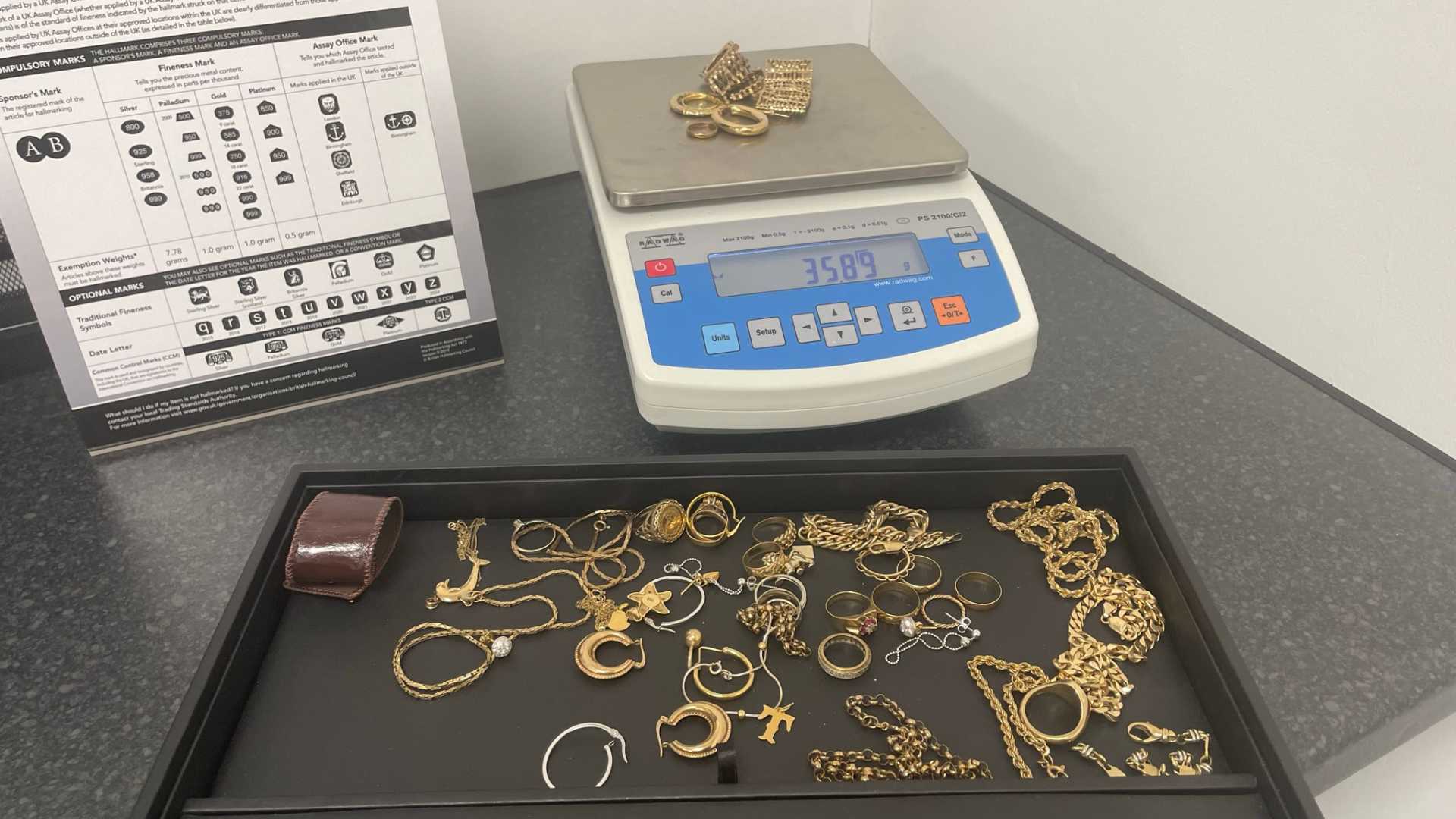

Nowadays, collateral loans are widely accepted as a way to unlock the value of valuables like fine art. The pawnbroker’s sign is visible on every high street in Europe and the West, and it signifies a place to get collateral loans.

Why Choose Sapphire Pawnbrokers

We lend based on the value of your item, not your credit score! Our experts will value your items and make you a cash offer. Find out more on our FAQ page